In 2024, M-Pesa users in Kenya are witnessing significant changes in transaction charges, a consequence of the Finance Act 2023.

This Act, altering the financial landscape, increased excise duty on mobile money services from 12% to 15%, directly affecting M-Pesa charges.

Let’s delve into the details of these changes and how they impact your transactions.

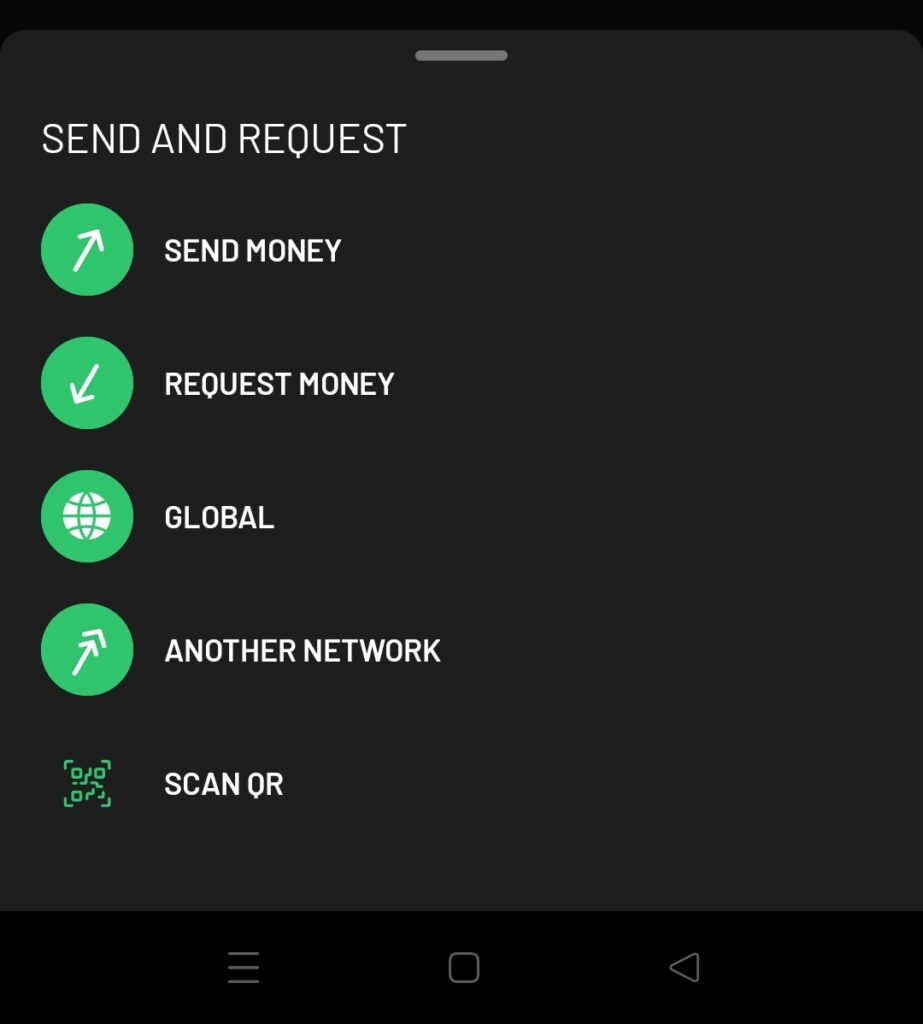

M-Pesa Charges for Sending Money

M-Pesa charges for sending money vary based on the transaction type. Sending money to other registered M-Pesa users and unregistered users now incurs different charges:

- Registered Users: The charges for sending money to other registered M-Pesa users have been revised.

- Unregistered Users: If sending money to unregistered users, the charges are different, reflecting the updates.

M-PESA Cost Calculator for Sending Money

Enter the amount you want to send:

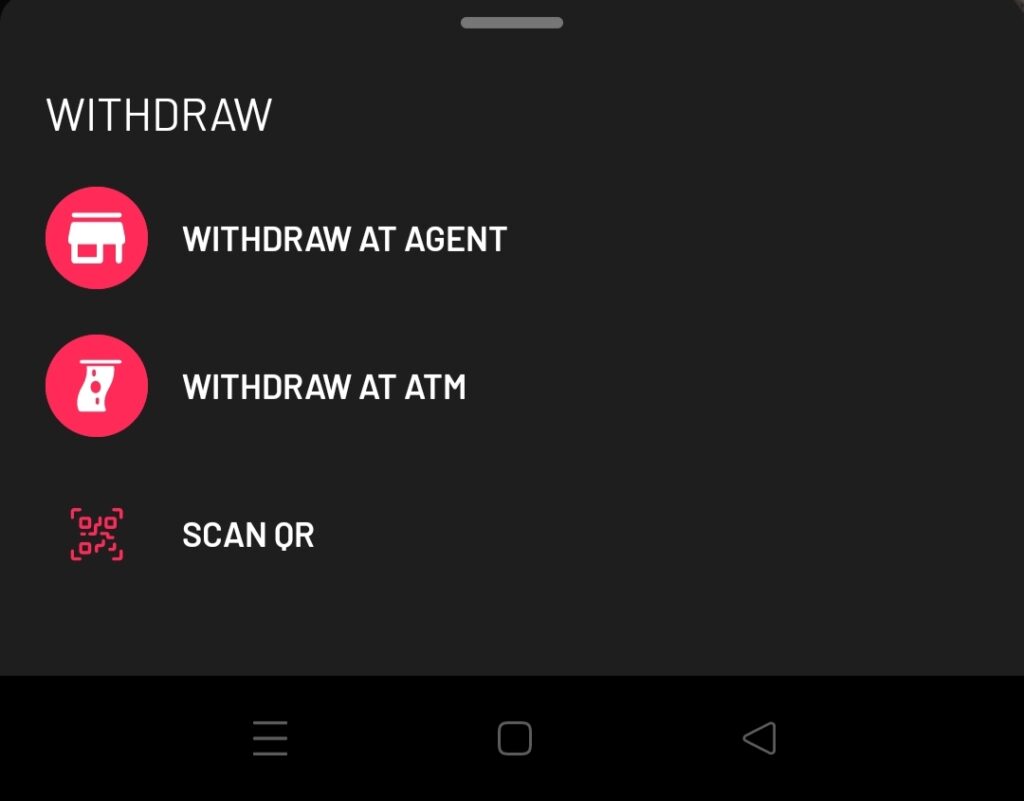

M-Pesa Withdrawal Charges

The withdrawal charges at M-Pesa agents and ATMs have been updated:

- M-Pesa Agent Withdrawal Charges: These charges depend on the amount being withdrawn. For instance, withdrawing between Ksh 10,001 and Ksh 15,000 will cost Ksh 162, and between Ksh 50,001 and Ksh 150,000, it costs Ksh 300.

- ATM Withdrawal Charges: Withdrawing money from ATMs also sees a change in charges, with different rates for various bands, like Ksh 34 for withdrawals between Ksh 200 and Ksh 2,500.

M-PESA Withdrawal Cost Calculator

Enter the amount you want to withdraw:

M-Pesa Agent Withdrawal Charges

| Min (Ksh) | Max (Ksh) | Withdrawal Mpesa Charges (Ksh) |

|---|---|---|

| 1 | 49 | N/A |

| 50 | 100 | 11 |

| 101 | 500 | 29 |

| 501 | 1000 | 29 |

| 1001 | 1500 | 29 |

| 1501 | 2500 | 29 |

| 2501 | 3500 | 52 |

| 3501 | 5000 | 69 |

| 5001 | 7500 | 87 |

| 7501 | 10000 | 115 |

| 10001 | 15000 | 167 |

| 15001 | 20000 | 185 |

| 20001 | 35000 | 197 |

| 35001 | 50000 | 278 |

| 50001 | 150000 | 309 |

Paybill Charges

The Paybill service, essential for bill payments and fund transfers, also experiences a change in charges in 2024. These changes aim to make financial transactions more affordable and accessible.

Other Transactions

Some transactions remain free of charge:

- All deposits

- M-PESA registration

- Buying airtime through M-PESA

- M-PESA balance inquiry

- Changing M-PESA PIN

Transaction Limits

M-Pesa also has specific transaction limits:

- Maximum Account Balance: The maximum amount that can be held in an M-PESA account is Ksh 300,000.

- Daily Transaction Limit: The maximum amount that can be transacted in a day is Ksh 300,000.

- Maximum per Transaction: The maximum amount per transaction is capped at Ksh 150,000.

Impact of Finance Act 2023

The Finance Act 2023 has been a game-changer for M-Pesa users. It recalibrated excise duty rates, affecting costs associated with M-Pesa services.

While the Act increased duties on some services, it eased up on others, like telecommunication services.

You may also like // Legit Online Surveys that pay via Mpesa

Conclusion

Understanding these new M-Pesa transaction charges is crucial for users to navigate their financial transactions effectively in 2024. The changes, influenced by legal and economic factors, reflect a dynamic financial environment in Kenya, emphasizing the importance of staying informed about mobile money trends.

For more detailed information on specific charges, users are encouraged to visit the official Safaricom website or their nearest M-Pesa agent.